Reporting entities can delegate the process of producing regulatory reports to another party, such as a liquidity provider (LP). The delegate performs the function of preparing and submitting the reports to the relevant authorities on behalf of the delegating party.

Delegated reporting is often used to save time and reduce operational costs. However, it is important to note that even in these circumstances, the delegating party retains ultimate responsibility for ensuring the accuracy of the information reported and may be subject to penalties or fines if the information is found to be incorrect.

Prefer to Watch?

Spot checks by a Regulator

When a regulator does an audit or a spot check to investigate a reporting counterparty and detects an anomaly, they will enquire directly to you, the delegating party, not the LP performing the reporting. As such, you need to ensure that you have completed and documented reconciliations and checks on a frequent basis, and have your submission data readily accessible to provide to the regulator.

What responsibilities are delegated to an LP?

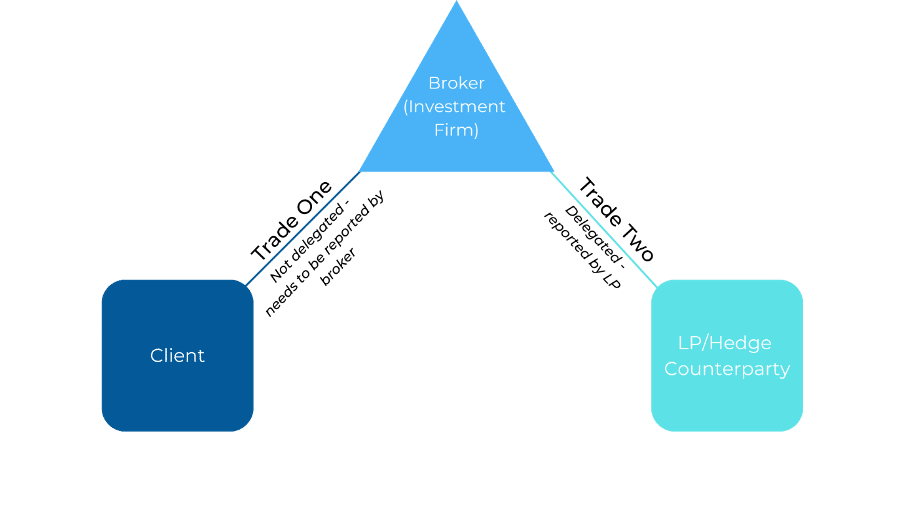

As a reporting entity, it is important to understand what you can and cannot delegate to your LP. The LP may be undertaking the reporting on your behalf; however, they can only cover the leg between themselves and you, not the underlying transactions between you and your clients.

Below is a visual representation of how TRAction would normally see the transaction flow and reporting requirements handled by the parties involved.

Firms should also consider whether their LP is reporting the transactions under the correct reporting regime. For example, an FCA broker may be using a Canadian LP and delegating the reporting of those trades. However, unless the Canadian LP is also reporting the trades under the UK reporting regime (in addition to their Canadian reporting regimes), this will not be sufficient for the FCA broker’s reporting requirements.

Similarly, a broker in Australia that is using an LP in the United Kingdom that has FCA reporting requirements will need to ensure that the single-sided reporting requirements are met under the ASIC rules, otherwise they will need to report these transactions to ASIC rather than just relying on the reporting done by the LP.

Conduct careful analysis to understand the transaction flow and reporting regimes where your firm has obligations is highly important.

What is Required from a Reporting Entity?

Ultimately, your firm is responsible for the reported information. You need to perform reconciliations to compare the data reported by the LP with your own records and ensure that the information is consistent and accurate. Reviewing the reports and comparing them to your own records, checking for any discrepancies or errors, and notifying them of any necessary adjustments is a good starting point.

It’s important to have a clear understanding of your regulatory reporting obligations and to be proactive in ensuring that accurate and timely information is reported by your delegate.

Assessing Confirmation Reports

Confirmation reports are the files provided back by the Trade Repository, usually straight after a trade report is submitted and processed by the TR.

They serve as a means of verifying that the reporting has been performed correctly by your LP and that the information provided is in line with your internal records database.

Confirmation reports provide an independent, third-party check on the information reported, helping to reduce the risk of errors or inaccuracies. In short, confirmation reports are an important tool for ensuring the accuracy and completeness of regulatory reporting, and help to demonstrate that the delegating party has taken steps to meet its obligations and responsibilities.

Use of a Third-Party Provider

There is another option of using a third-party service provider, like TRAction, for regulatory reporting.

Using a third-party can have several benefits, including:

- Expertise: Third-party service providers have specialised expertise and experience in regulatory reporting, which can help ensure that the reports are accurate, complete, and in compliance with all relevant regulations.

- Efficiency & cost savings: Third-party providers can often complete the reporting process more efficiently than in-house staff by utilising economies of scale and a more streamlined process, freeing up time and resources for other tasks.

- Risk reduction: By using a third-party provider, the risk of errors or inaccuracies in the reporting process is reduced, as the provider has the knowledge to ensure compliance with all relevant regulations.

- Access to technology: Third-party providers often have access to specialised software and technology for preparing and submitting regulatory reports, which can help improve the accuracy and efficiency of the reporting process.

Summary

TRAction remains committed to making trade reporting simple by staying ahead of regulatory developments and monitoring for changes that may affect our clients. Don’t hesitate to contact us if you would like to know more.