The Unique Product Identifier (UPI) is a new field and a component of the common data elements (CDE) which apply under EMIR, UK EMIR, ASIC, and MAS. Its purpose is to identify an OTC derivative product. The Unique Product Identifier is mandated for use alongside the existing Legal Entity Identifier (LEI). The LEI identifies the parties to a derivative trade, whilst the Unique Product Identifier identifies what derivative product was traded.

The UPI is comprised of specific values on reference data components which sit in the UPI Reference Data Library on ANNA-DSB. The use of UPIs is the same for EMIR, ASIC, MAS and CFTC – read more here in the context of their application under UK EMIR.

The UPIs from the UPI Reference Data Library are managed and shared by ANNA DSB in a similar manner to ISINs. (See more from ANNA DSB). Having one centralised place for UPIs aims to reduce inconsistency and will hopefully reduce the volume of reportable fields in the future, as many separate data elements can be obtained from the UPI.

TRAction’s UPI Service

At TRAction, we provide a service for our clients to retrieve or generate UPIs. This is a key part of transaction reporting for firms which have not already obtained the UPI from their counterparty or the UPIs do not exist because TRAction’s client is the product manufacturer.

When performing a UPI search on behalf of our clients, we are able to extract and receive most of the data directly from the database table we store about our client’s derivative instruments, based on product attributes.

Do you need an account with ANNA DSB?

TRAction clients aren’t required to have an account with ANNA DSB in order to conduct their transaction reporting.

Non-TRAction clients can create a profile with ANNA-DSB to search and create UPIs. There are several user types available for access to the UPI Reference Data Library which can be found on the ANNA DSB website along with the relevant fees. DSB requires users to provide an active LEI to enable the DSB to verify the identity of the user on GLEIF

How do you obtain a registered UPI?

TRAction clients will benefit from our UPI retrieval and creation which is included in most pricing plans.

For non-TRAction clients, there are a few methods of obtaining information from ANNA DSB other than through a search, such as:

- Graphical User Interface (GUI) (manual)

- Programmatic Interface (FIX API, ReST API)

- File Download (periodic publication of UPI records

TRAction explores how new UPIs are submitted and how current UPIs are extracted from the Derivatives Service Bureau (ANNA DSB), the only service provider for UPI – please see our article here.

Technical information and documents can be found on ANNA DSB’s website.

Background

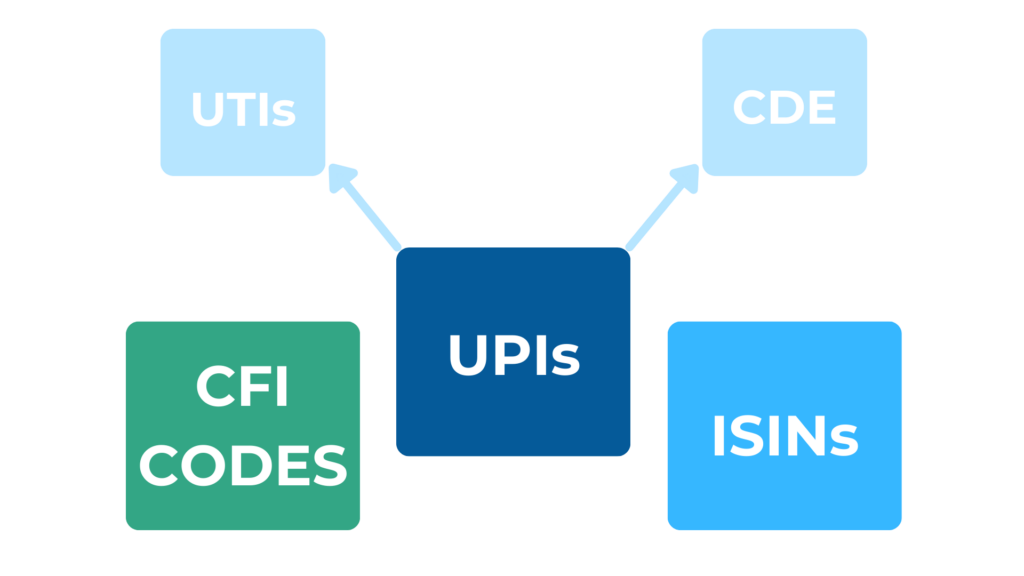

Prior to EMIR, there was no universal system of identifying financial instruments. EMIR reporting often previously included a mix of CFI codes and ISINs, the interpretation of which was confusing for investment firms as to what exactly was required.

The issue with CFI codes is that they are often presented incorrectly and don’t correspond to the same data reported elsewhere in the same report (such as delivery type). Populating solely the first two characters out of six, leaving the remaining characters as XXXX (for example JRXXXX) is an all-too-common reporting error. Since EMIR came into effect, the entire CFI code needs populating for accurate reporting.

Conceptually, UPIs sit between CFI codes and ISINs, both of which are currently EMIR reportable fields. The UPI will work in conjunction with Unique Transaction Identifiers (UTIs) and Critical Data Elements (CDE) which are also expected to be reportable to global regulatory authorities. In the first instance, UPIs are designed to uniquely identify financial instruments involved in OTC derivative transactions to be reported to a trade repository (TR).

How TRAction can help?

TRAction, as a third-party service provider, assists our clients to ensure UPIs are reported consistently and accurately by extracting data directly from ANNA DSB. Should you need further clarification on how UPIs will affect reporting requirements, please get in touch with us.