TRAction's Services

Our Service Plan

TRAction can help you manage your obligations

Regulatory trade and transaction reporting can be complex and unwieldy. It ties up firm resources that could be otherwise used in the delivery of your products and services.

Different regions around the world have different reporting obligations, so if you’re a cross-border business or aspire to be one, you’ll face multiple sets of regulatory regimes of which you must get on top of.

Services we offer

Whether you are just looking to switch your reporting delegate or transition between TRs/ARMs, TRAction manages every stage of the transition effectively and without complication.

TRAction's Services In Detail

Want to know more about our services? Watch our helpful new video for more information!

Don't let your reporting slip

Turn on TRAction Control.

TRAction helps you keep your reporting on track. Learn more about our suite of products and procedures to keep your trade reporting from sliding out of control.

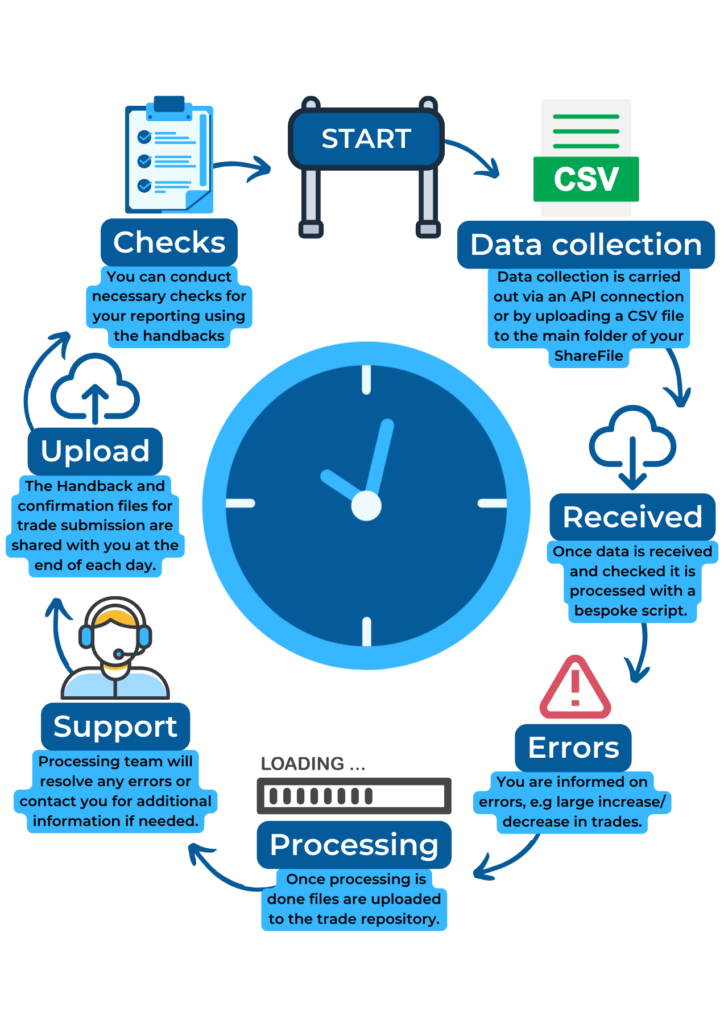

TRAction's processing and handback timeline

Details about our services

Benefit of using a delegated reporting service

The fundamental benefits of using a delegated reporting provider include:

- relieve burden on human and internal resources assigned to trade reporting;

- understand the trade reporting obligations;

- ensure the reporting requirements and industry standards are met; and

- stay informed and up-to-date with any regulatory change.

We make the process a whole lot easier and more cost-efficient than if you were to devote your internal compliance, legal and management resources (or in some cases external compliance and legal resources) to managing your trade/transaction reporting obligations.

Data extraction, conversion, and enrichment

There’s a number of ways our clients send us the data required for their daily reporting.

- We have developed customised solutions to directly extract the necessary data from the most commonly used trading platforms. These integrations minimise the risks associated with human intervention as part daily data processing that is necessary for many other methods. Read more about available integrations on our dedicated page.

- By connecting directly to our client’s API, we are able to pull the data which can be enriched and processed and then uploaded to the trade repository. This is a hands-off method for our clients which boosts their reporting efficiency by requiring minimal manual input.

- Some of our clients wish to host an SFTP server whereby TRAction connects and pulls the data down to be processed and enriched.

- In situations where we are unable to connect to our client’s database, or where it is easiest, CSV files are uploaded to Sharefile.

After data extraction, we convert, enrich and validate your data into the required reporting format. This process ensures your trade data meets the submission requirements prior to final submission to TR/ARM.

Reporting trades on your behalf

A key benefit to delegating your reporting to TRAction is that we do all the necessary and often complicated onboarding work for you with the TR/ARM. We manage any exceptions in your data before and after submitting your trade/transaction information.

We’ve summarised how TRAction can make your reporting process more efficient and stress-free under EMIR, MiFIR/MiFID II, SFTR, Best Execution, MAS and Canadian Reporting.

Reporting guidance and support

Compliance and operational staff at financial firms are required to stay abreast of regulations on a wide range of topics which are becoming increasingly detailed over time. This makes it almost impossible for small teams to properly implement all of them single-handedly. Specialist regulatory technology providers such as TRAction have sprung up to help firms with managing this diverse array of serious requirements.

On top of grappling with the complexity of the reporting requirements, applying them to your business creates and keeping them up to date as the rules change creates an added layer of difficulty.

We assist our clients by explaining transaction reporting requirements in an easy-to-understand manner, interpreting unnecessarily complicated industry jargon which can appear in the rules. We provide regular industry updates so that clients stay informed of regulatory changes.

Costs of TRAction's services

All of our services add significant value to your business and come at a similar cost to what you would otherwise pay if you went directly to a trade repository (TR) or approved reporting mechanism (ARM). We bill you directly and manage your relationship with the TR or ARM on your behalf to ensure your reporting runs smoothly.

Through the industry experience of TRAction’s staff and the knowledge gathered engaging with regulators and trade repositories, TRAction is well-placed to help you navigate the complexities of complying with the trade/transaction reporting rules.

View our pricing schedules.

TRAction's Trade Reporting Process

Contact us

Can't find the answers you're looking for?