TRAction often receives requests from new clients to backload their hedge trades as they had incorrectly assumed:

- their liquidity providers (LPs) had been reporting on their behalf; or

- those trades are not reportable.

Failure to report your hedge trades not only is a breach of your EMIR/UK EMIR reporting obligations but can also attract serious financial penalties from your National Competent Authority (NCA). Hence, it’s important for you to ensure your hedge trades are reported. This article provides you some guidelines on:

- Who should ensure hedge trades are reported?

- How to report the trades?

1. Whose responsibility is it to ensure hedge trades are reported?

We’ve included diagrams below to explain the hedge trade requirements under both EU and UK EMIR.

The responsibility rests with the corporate counterparty in the:

- European Economic Area (EEA) under EU EMIR; and

- United Kingdom under UK EMIR.

However, when a Non-Financial Counterparty below the clearing thresholds (NFC-) trades with a Financial Counterparty (FC), the responsibility lies with the FC.

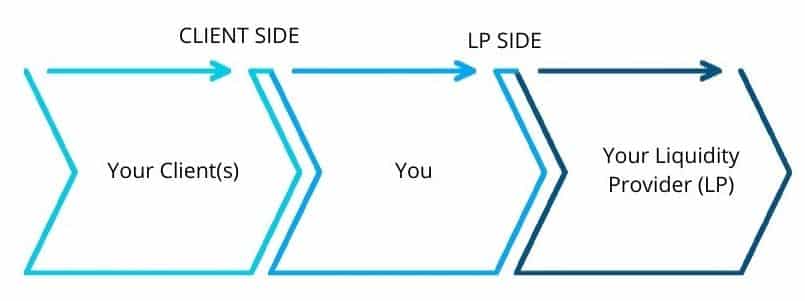

When you hedge your client(s’) trade(s) with your LP, how many reports do you need to submit?

- You vs Client side; and

- You vs LP side.

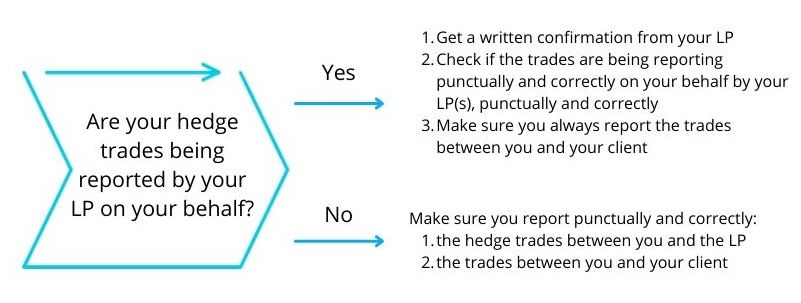

When you delegate the reporting of the LP side of trade, the LP will report for both parties. However, you must not forget to report the client side of trade as the LP will not report this side of the trade for you.

2. How to report the trades?

Get in touch with your LP(s) and discuss their EMIR reporting processes in relation to the trades you enter into with them.

Even if the LP is just an intra-group firm, you will still need to report the trade between you and the intragroup LP.

TRAction works closely with common aggregators and LPs and has experience in processing files in formats provided by these entities.

Reminder: update your reporting delegate with any LP changes

Brokers often change their LPs for commercial and competitive reasons. As a reporting delegate we are unable to identify any addition or removal of an LP unless we are informed. Often clients overlook or forget to inform us about such changes which can result in these hedge trades for the new LP not being reported. We remind clients to promptly inform us of any LP changes to avoid missing any trades. We also encourage you to conduct regular reconciliations to ensure all LPs are properly accounted for in your reporting.

Please don’t hesitate to get in touch with TRAction to discuss your specific circumstances.