Entering into derivative transactions, you become a ‘counterparty’.

EMIR introduces two types of counterparties:

- Financial Counterparties (FC) include banks, investment managers, insurance companies or brokers.

- Non-Financial (NFC) include all entities that are not Financial Counterparties, nor central counterparties.

EMIR further distinguishes two sub-categories of Non-Financial Counterparties (NFC) according to whether their over-the-counter (OTC) derivative positions are above or below designated clearing thresholds in notional value, these being NFC+ or NFC-.

What Do I Have to Do?

EMIR obligations apply differently based upon the counterparty’s classification:

| EMIR Obligation | NFC- | FC- | NFC+/FC+ |

| Trade Reporting | X | X | X |

| Central Clearing | X | ||

| Timely Confirmations T+2 | X | ||

| Timely Confirmations T+1 | X | X | |

| Market to market/model valuation | X | X | |

| Margining | X | X | |

| Portfolio Reconciliation | X | X | X |

| Dispute Resolution | X | X | X |

| Portfolio Compression | X | X | X |

How do I Determine my FC/NFC Status?

In order to determine this status, Financial Counterparties and Non-Financial Counterparties trading OTC derivative contracts are obliged to annually calculate the average of their end of month positions over the last 12 months aggregated at the group level, and compare it to the following clearing thresholds:

| Asset Class | Threshold |

| Credit derivatives | €1 bn |

| Equity derivatives | €1 bn |

| Interest rate derivatives | €3 bn |

| FX derivatives | €3 bn |

| Commodities and other derivatives | €3 bn |

When a Non-Financial Counterparty (NFC) determines that its average end-of-month positions do not exceed any of the above asset class clearing thresholds, it is classified as a ‘Non-Financial Counterparty below the clearing thresholds’ or NFC-. This means that it is exempt from the clearing obligation, but remains subject to transaction reporting requirements.

Conversely, where the result of such calculation with respect to one or more of the OTC derivative classes above exceeds the clearing threshold (or when an NFC does not calculate its positions), it is considered an NFC+ and therefore:

- Must immediately inform ESMA

- Must establish clearing arrangements within 4 months

- Is subject to transaction reporting requirements and collateral exchange requirements

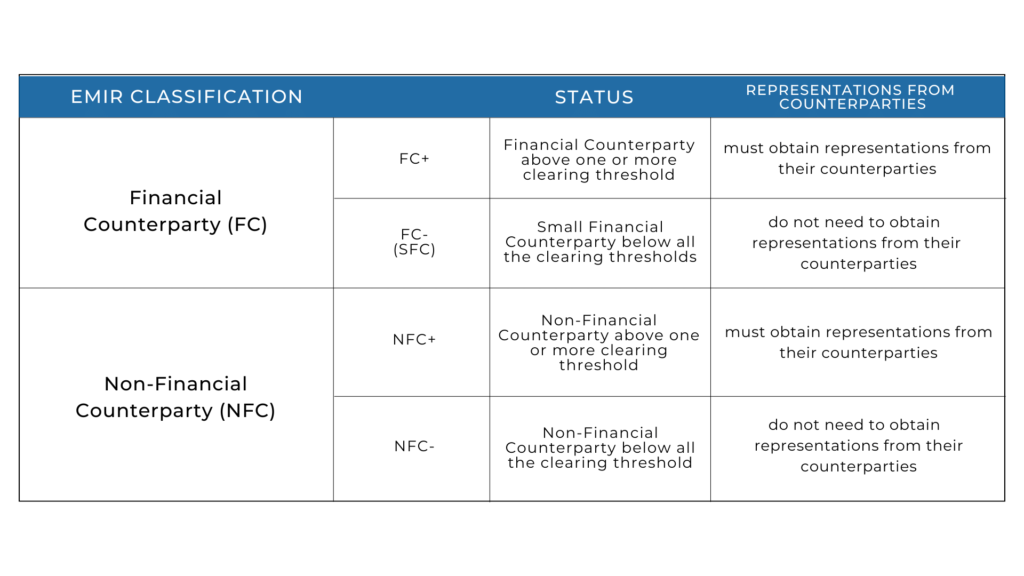

A counterparty should obtain representations from its counterparties detailing their threshold status. However, counterparties that are not subject to the clearing obligation (an EMIR requirement for which they would need to know the status of their counterparties) do not need to obtain representations from their counterparties. The table below summarises this, with the categorisation of counterparties under European Markets Infrastructure Regulation (EMIR):