Reporting of Milliseconds

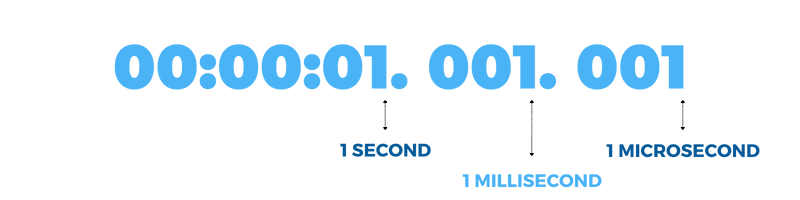

When reporting transactions to regulatory bodies, there are variations in the data format that is required from region to region. An example of this difference is the accuracy of the timestamp that is deemed acceptable. Under MiFID II/ MiFIR, milliseconds are required in an attempt to increase the transparency and detail of the information passed to the regulator.

Regulatory Impact

MiFID II mandated transactions be timestamped with much more accuracy. Regulated organisations are required to maintain a much clearer picture of time across the lifecycle of a trade, as defined under MiFID II through RTS 25. One of the objectives of this increased regulatory scrutiny is to boost market surveillance and reduce market abuse through the reconstruction of transactions with accurate time sequencing.

MiFID II requires accuracy as detailed as microseconds for high frequency trading in an effort to oblige firms to demonstrate that they have taken sufficient steps to ensure best execution for their clients; on both the buy and sell side.

Under MiFID II RTS 22, this scrutiny is currently reserved for transactions traded on a trading venue, with the granularity required set out in Article 3 of RTS 25 on clock synchronisation. For transactions that are not TOTV, the time reported should be rounded to the nearest second.

Timestamp Granularity Summary

The table below outlines the timestamp reporting accuracy required for different types of trading activity. Legacy trading through the use of voice orientated or request for quote systems can be rounded to the nearest second, whereas algo trading techniques or other TOTV transactions necessitate a much higher degree of specificity.

| Type of Trading Activity | Max Divergence From UTC | Granularity of Timestamp | Granularity Example |

| Activity using high frequency algo trading technique | 100 microseconds | 1 microsecond or better | <00:00:00.000.001 |

| Activity on voice trading systems | 1 second | 1 second or better | <00:00:01.000.000 |

| Activity on request for quote where system does not allow algo trading | 1 second | 1 second or better | <00:00:01.000.000 |

| Activity of concluding negotiated transactions | 1 second | 1 second or better | <00:00:01.000.000 |

| Any other trading activity | 1 millisecond | 1 millisecond or better | <00:00:00.001.000 |

The Rise of Algorithmic Trading

With transaction volumes topping multiple trillion dollars a day and a large percentage of this increasingly coming from algorithmic trading, the rise of high frequency trading has become a hot topic. Over the last 15 years, the market has seen the spectacular development of HFT from within dark pools and general obscurity to the forefront of the investment management industry. This has led to speed-dependent algorithms growing in importance as institutional and retail investors harness improving computing power and open-source projects such as GitHub.

Monitoring High Volatility Events

Major news events such as non-farm payrolls or FOMC minutes which tend to spur volatility have become the ideal opportunities for low-latency connections as these technological advancements have become more pronounced in the financial system. As such, this is among one of the many reasons that the EU started to push for more clarification and increased accuracy from reporting entities under their regime.

Summary

As this area of the industry develops, TRAction remains committed to making trade reporting simple by staying ahead of regulatory developments and monitoring for changes that may affect our clients. Don’t hesitate to contact us if you would like to know more.