ESMA recently released their Data Quality Report which presented analysis of the quality of data which was collected for regulatory use in 2021 under the EMIR and SFTR transaction reporting regimes.

ESMA outlined several prerequisites for further enhancing data quality which need to be addressed by counterparties, namely the need to ensure the:

- completeness and accuracy of the reported information, in particular with regards to the reporting of valuation and collateral data,

- timely submission of the reports, and

- consistency of reported information reflected in the reconciliation of data submitted by the two counterparties of the same derivative/transaction.

A key trend across the period covered by the report was the decrease in volumes post Brexit which led to UK counterparties no longer reporting under ESMA’s EMIR and SFTR regimes. Prior to Brexit, the number of potentially non-reported derivatives stood at around 3.5 million, around 5% of open reconcilable derivatives at the end of 2020. This dropped sharply to around 0.5 million or around 1% in the post Brexit environment.

EMIR Highlights

Overall, compared with the previous year, the report demonstrates that reporting errors were drastically reduced; for example, there was a 50% decrease in the misreporting of valuations.

Specific figures that should get the attention of counterparties in the industry are the rejection rates which continue to be low, around 2% with only 1% of records in the TRs not complying with applicable validation rules. Where a counterparty has a distinctly higher rejection rate on their reporting, they may be more likely to be flagged to the regulator. Some scenarios that TRAction has seen in the industry are where:

- a firm is self-reporting and doesn’t have sufficient understanding or expertise internally to complete the reporting correctly;

- deliberately submitting unverified and unvalidated data to a TR and resolving problems later once a rejection is received.

There are some other areas identified in the report where counterparties should boost their reporting efforts such as:

- Reporting Timeliness – While less than 10% of reported derivatives tend to be reported late by the counterparties, more than 20% do not receive an updated valuation daily, as required by EMIR. At TRAction we prioritise ensuring that our client’s data is reported within the regulatory timeframe by maintaining strong communication lines and providing prompts to clients where files/data are not received or there are any other delays in processing.

- Reconciliation – continues to be an area of concern for ESMA in their review of counterparties’ reporting compliance. Pairing rates continue to be subdued at around 60%, with roughly 5 million of reconcilable derivatives unpaired. On average there is about a 5% difference between the number of open derivatives reported between two counterparties engaged in dual reporting. The workload on behalf of the counterparty to achieve compliance with this requirement can be greatly reduced if they share a common delegated reporting provider such as TRAction; please read our article on pairing and matching for more clarity on the area.

Some other interesting highlights from the report has been presented in helpful graphs extracted below, to which we have attached some commentary.

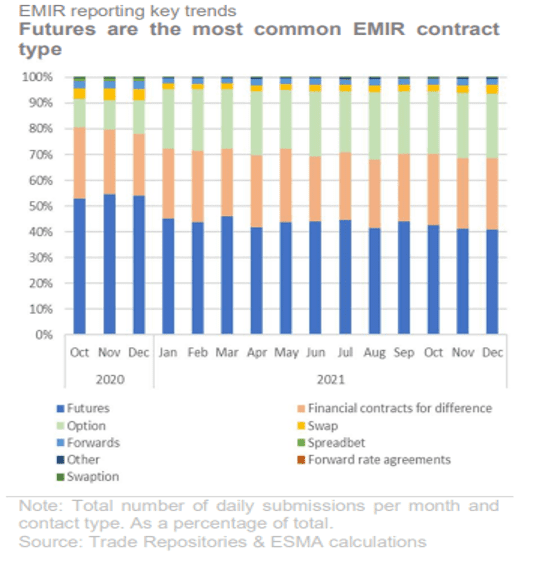

Most Common Contract Types & Asset Classes Under EMIR:

Chart 1 demonstrates that futures are by far the most common contract type reported under EMIR. Futures and Financial CFDs on average reflected around 70% of all reporting volumes from October 2020 through to the end of December 2021.