What is an LEI?

A Legal Entity Identifier (LEI) is a 20-digit alpha-numeric code based on the standard developed by the International Organization for Standardization (ISO).

LEI codes enable the clear and unique identification of legal entities which are participating in financial transactions; examples include, but are not limited to, brokerages, banks, and investment companies. The aim is to facilitate enhance transparency in the global markets. The LEI dataset can be thought of as a global directory, providing ownership information on market participants.

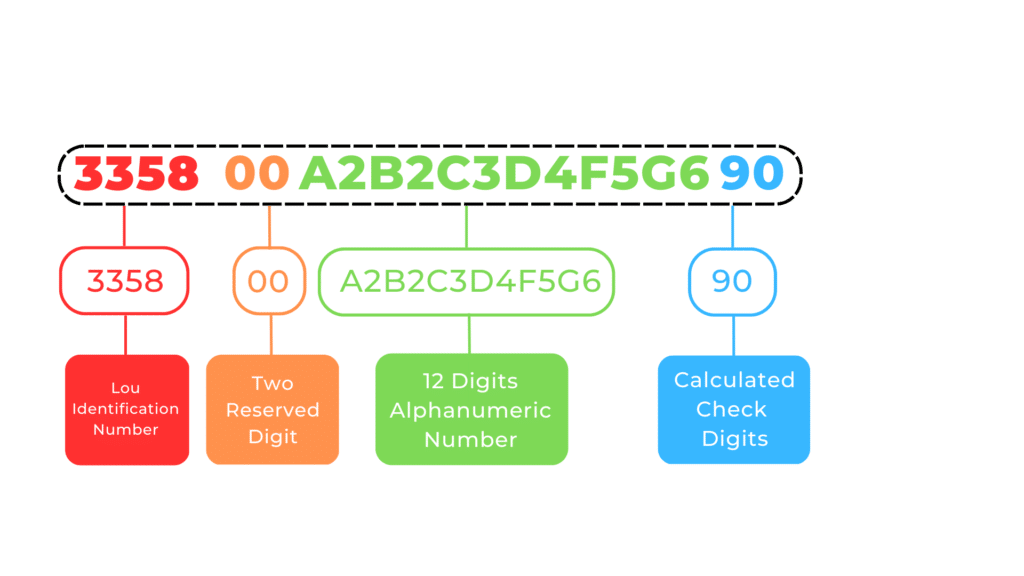

The LEI code is constructed by several parts. The first four digits identify the local operating unit, the next two are always 0, characters 7-18 are unique to each entity, and the last two are used for verification purposes. See the diagram below:

Breakdown of an LEI

How are LEIs used?

The LEI is used in financial transactions to facilitate data matching and aggregation, as well as the tracking of activity by entities across different jurisdictions. It also needs to be renewed annually, to ensure that the data remains up to date and accurate. This creates a global network which regulators and participants can leverage to understand ‘who is who’ and ‘who owns whom’.

Who needs an LEI?

LEIs are required for any entity operating within the financial system acting as a counterparty in transactions or fulfilling secondary roles. This includes companies that buy and sell, or make a market in financial securities.

Under current regulations in many jurisdictions (e.g. UK and EU), a legal entity may be prevented from trading if it does not have an LEI.

LEIs Within Regulatory Reporting

Since the financial crisis in 2008, regulators have continuously sought to enhance the transparency of the financial markets and the data they monitor, in an attempt to prevent the recurrence of past failures. When fulfilling regulatory reporting obligations, any entity that has an LEI must be reported with this identifier, so that overseeing bodies are able to monitor and assess any transactions that are taking place under the legal entity across different jurisdictions. LEIs have created a harmonious playing field for enhanced oversight in the area of transaction reporting.

We have prepared a summary of the LEI requirements for the major reporting regimes.

How can TRAction assist you with your LEI?

TRAction’s mission statement is ‘Trade Reporting Simplified’. This reflects our commitment to supporting our clients across the entire spectrum of their regulatory reporting obligations.

We assist our clients with lodging their initial LEI application and handling their annual renewal, helping to mitigate scenarios where the LEI inadvertently lapses and prevents on-time submission of transaction reporting data. We also find that many investment firms find the renewal process complicated and time-consuming. By managing many renewals each year, TRAction is able to help streamline processes and further reduce the workload of compliance teams.

Summary

As this area of the industry continues to evolve, TRAction remains committed to staying ahead of regulatory developments and monitoring for changes that may affect our clients, for example, the recent EMIR refit, and ASIC and MAS rewrites. If you would like further information or assistance, don’t hesitate to get in touch with us.