Under EMIR Refit, the information stemming from the dual-sided reporting obligation must be reconciled via the pairing and matching of both legs of the derivative trade by trade repositories. The successful reconciliation of dual-sided reporting data:

- enhances data quality,

- increases the transparency of the derivatives markets, and

- enables authorities to effectively monitor systemic risks to financial stability.

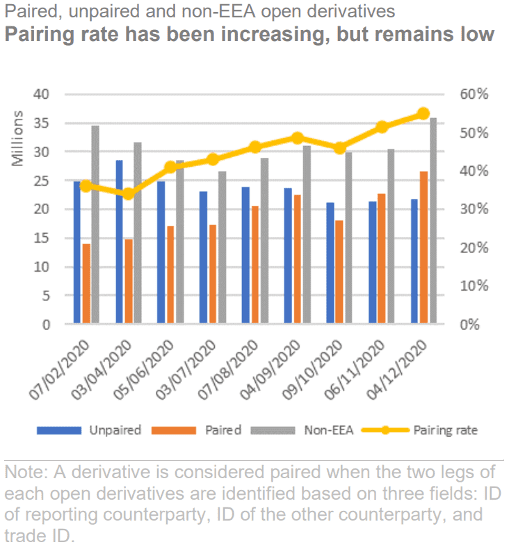

Historically, pairing has been problematic. The graph below shows the results of ESMA paired open derivatives through 2020. Although the pairing rate has increased from around 40% to 53%, it is still very low considering that until EMIR Refit, successful pairing required counterparty agreement on only 3 fields.

Source: ESMA EMIR and SFTR data quality report 2020

The lack of pairing has been attributed to disagreement on the generation of the UTI, non-reporting (i.e. incomplete, untimely and unavailable data), or on position versus trade level reporting.

EMIR Refit has introduced further rules on the structure and generation of a UTI which will build a better foundation for pairing and matching.

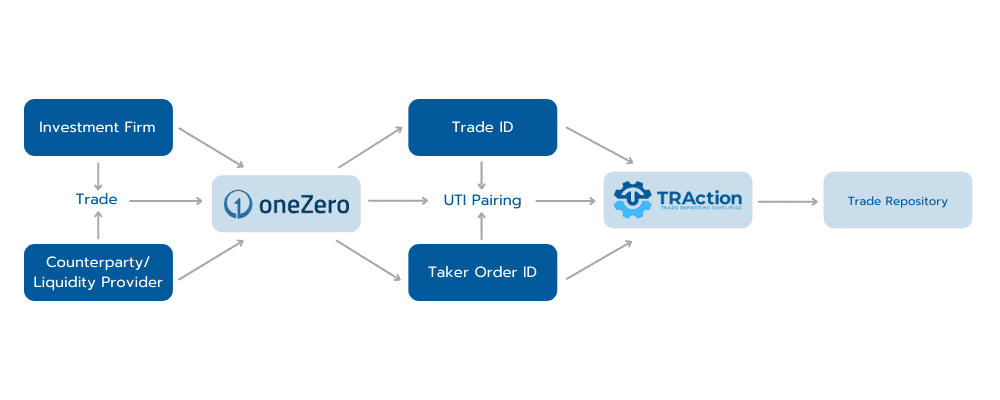

Another way for clients to make the pairing and matching obligation easier on themselves is to use execution technology providers such as oneZero.

oneZero provides a bridge between trading systems, such as MT4 and MT5, and hedging counterparties/liquidity providers (LPs). This means that when a client places a trade with an investment firm on an MT4/MT5 platform, that trade will pass through the oneZero bridge and can be executed as is with an LP or aggregated with other client positions and then an aggregated trade executed with an LP.

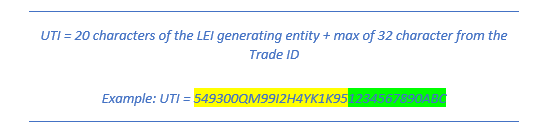

This creates a reportable execution between the investment firm (who took the client trade through the MT4/MT5 system) and the LP who took the execution through oneZero. Under EMIR, both counterparties need to report the same UTI, reporting counterparty ID and the ID of the other counterparty in order to successfully ‘pair and match’ trades (assuming they are both caught under the EMIR obligation).

oneZero creates the unique part of the UTI which can then be shared between both counterparties. The investment firm would receive the shared a ‘Trade_ID’ field in their trade files and the LP would receive the same ID in the ‘Taker_Order_ID’ field.

This Trade ID can then be appended to the LP’s LEI to create the EMIR Refit compliant UTI.

This helps create a medium where both counterparties can pick up and report the same UTI for the EMIR obligation as well as other jurisdictions which help make reconciliations easier for the relevant regulators, this is mentioned in the EMIR Q&A:

‘Article 4 of the Commission Implementing Regulation (EU) No 1247/2012 specifies that in absence of global unique trade identifier endorsed by ESMA, a unique code should be generated and agreed with the other counterparty (Table 2, field 12). This means that only one Trade ID should be applicable to any one derivative contract that is reported to a trade repository under EMIR and that the same Trade ID is not used for any other derivative contract. It is also acknowledged that contracts reported under EMIR rules might also reported under the rules of other jurisdictions. Hence, the same Trade ID should be allowed to be used in both those jurisdictions for reporting the given contract in order to facilitate the reconciliation among all the data sets.’

It is also worth noting that if for example, there are two oneZero clients who trade with each other, the OZ_Maker_Trade_ID of one client will match the OZ_Maker_Trade_ID of the other client who is acting as an LP to the first client.

Similar requirements are being implemented in other jurisdictions such as ASIC and MAS later in 2024.

If you would like to know more about oneZero or how TRAction can help with reporting from oneZero please don’t hesitate to contact either firm, see contact details below: