Background: Clearing, Prime brokers and bilateral arrangements

When financial firms want to trade with each other there are several risks involved, one of which is credit risk. This is the risk where a firm might not be able to ‘pay up’ for losses on a bilateral trade. This risk may be mitigated or resolved by introducing a 3rd party (i.e. someone who is more trusted or credit worthy) into the trade lifecycle. This arrangement can result in more complicated trade reporting obligations and intricacies.

Reporting exemptions

There are a few exemptions from EMIR reporting which are relevant to cleared trades and in respect of entities acting in an agent or broker capacity.

1. Cleared trades

There are 2 exemptions for cleared trades (dealt with in Article 2 of Regulatory Technical Standards (RTS)):- (i) For derivatives that have already been reported under Article 9 of EMIR and then subsequently cleared by a central clearing counterparty (CCP) (and cannot just be any clearing house), that contract should be reported as terminated. This is done by specifying the action type: ‘Early Termination’ in field 93 in Table 2 of the Annex. Only the contract resulting from clearing is to be reported in this instance.

- (ii) Contracts that are cleared same day and also concluded on a trading venue have a similar result to the above – only the contract resulting from clearing is to be reported.

If clearing of the derivative by a CCP has not occurred on the same day or it is concluded off venue, then the original state of the derivative should be reported.

After it is cleared, the original trade should be terminated by filling out the fields as follows:

- action type: ‘Terminate’; and

- event type: ‘Clearing’.

- action type: ‘New’ (or if relevant, ‘Position Component’);and

- event type: ‘Clearing’.

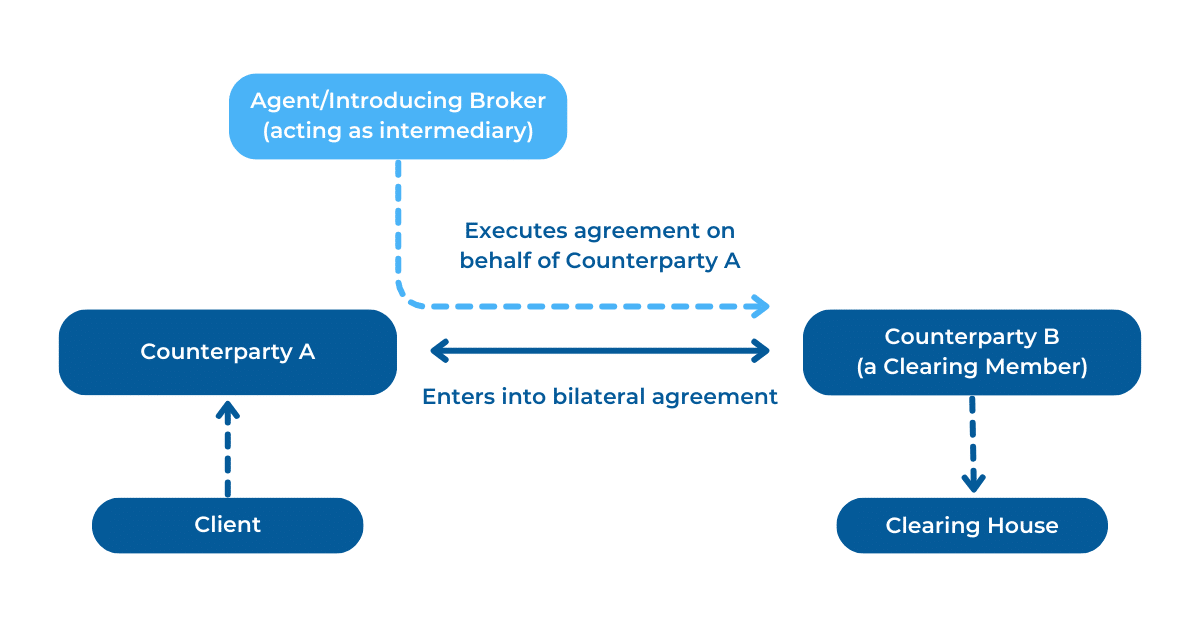

2. Acting under Give-up or Agency models

In circumstances where you are an intermediary to a derivative contract i.e. acting as an introducing broker or agent, you are not required to report under EMIR.

If your role is only to execute the order on behalf of your client in the trading venue or by receiving and transmitting the order and you are actually not becoming a party to the trade directly, then you are essentially only the agent, in legal terms.

This is why EMIR does not consider such capacities as falling under the scope of a ‘counterparty’ to the relevant transaction. Rather, the client you are acting on behalf of by executing the contract, is the counterparty along with the party it is facing in the relevant transaction. See below diagram.

In the above circumstances:

- the client of Counterparty A (if any), should be reported as a ‘beneficiary’ by Counterparty A in its report; and

- the Agent/introducing broker should be identified as ‘broker’ by both Counterparties A and B in their reports.

Note, if you are an investment firm who acts as an introducing broker or agent and give-up a transaction (on behalf of your client) to the clearing member within the T+1 reporting deadline and the original trade’s economic terms have not been varied, the trade should be reported in its post give-up state.

If your firm is acting in more than one role e.g. also acting as a clearing member (who is considered a counterparty and therefore is caught by the EMIR reporting requirements), then you do not have to report separately for each capacity and only need to submit one report identifying all the applicable capacities in the relevant reporting fields.

How can TRAction assist?

Should you need further clarification whether EMIR reporting applies to your business models or transactions, get in touch with us.