What is a Stock Split?

Stock splits typically occur when a company’s share price has risen to a level that may be perceived as too high or inaccessible for new investors entering into the market. To address this, a company may increase the number of its outstanding shares by dividing existing shares into multiple new ones. The primary objective is to make the share appear more affordable and appealing to a broader range of investors, while maintaining the company’s overall market value.

Stock Split Example

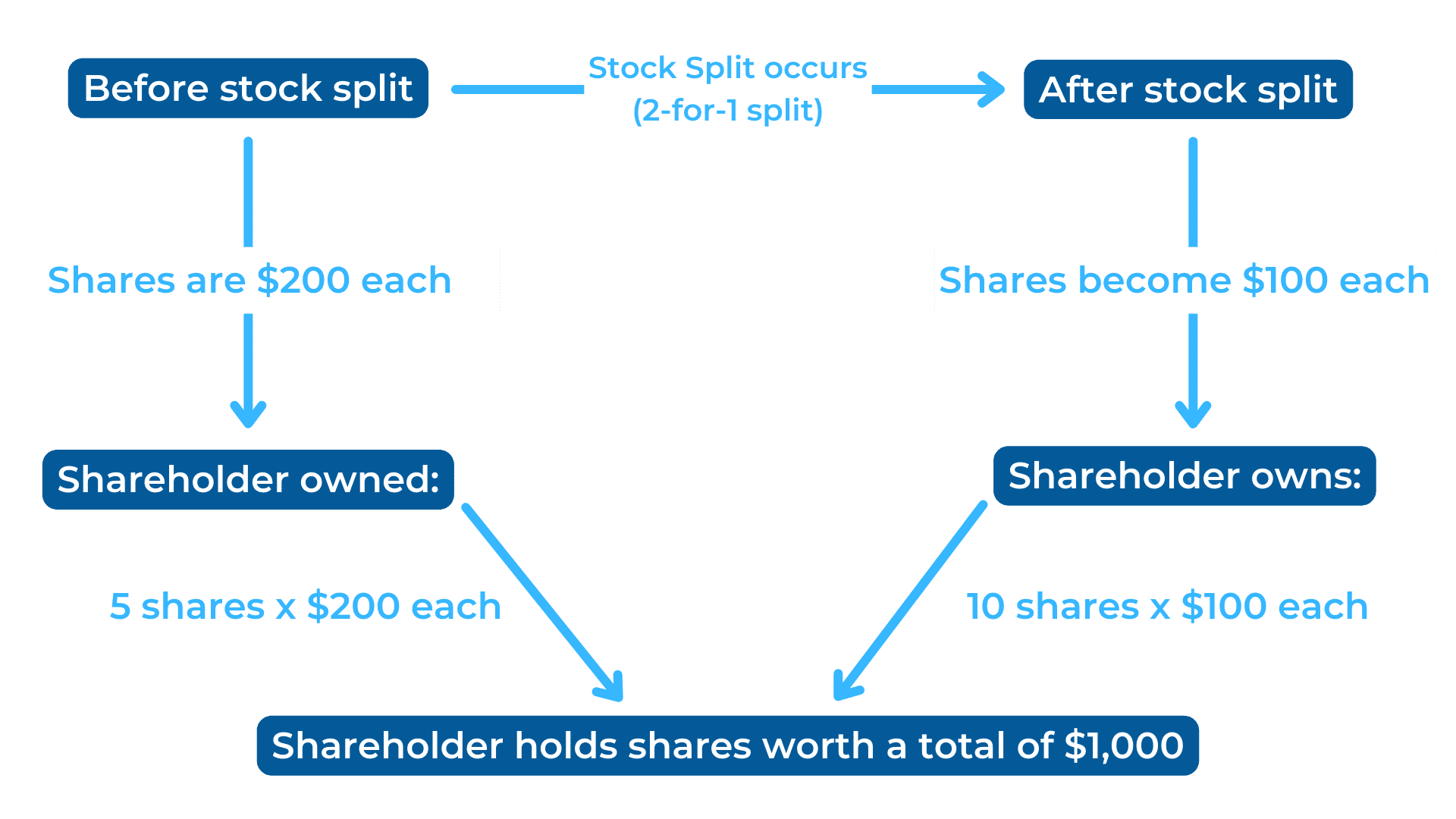

See below for an example of how a 2-for-1 split stock split occurs:

Are Stock Splits reportable under EMIR Refit?

Stock splits (causing a change in the nominal value of the trade) are reportable under EMIR. This is on the basis that reported underlying identifiers, such as the ISIN or LEI, or other transaction terms, change.

How are Corporate Events reported, and what steps should be taken before reporting?

Ensure that you have the following information before completing the report:

- Determine what the corporate event is. This could include stock splits, mergers, takeovers and insolvencies.

- What is the ‘Event Date’? That is, the date when the corporate event occurred.

- Do you have the updated trade details? All relevant trade details should be updated to align with the actual details of the corporate event. For a stock split, this would include amendments to the nominal value and number of shares held.

- What notional value to report? Notional values of ‘0’ should not be used. Rather, ensure the notional value represents the updated or new terms after the relevant corporate event.

In addition to the above steps and information being necessary for entry into the trade repository system, Table 12 of ESMA’s Final Report shows the way stock splits (or changes in nominal value) should be reported:

- Business Event → Corporate Action (assuming the corporate action has happened within the underlying instrument/issuer).

- Action type → Modify (use the appropriate code ‘MODI’)

- Event type → Corporate Event (use the appropriate code ‘CORP’)

ESMA has noted issues with reporting on CFDs over split stock

ESMA has identified reporting issues related to CFDs following stock splits. Specifically, in cases where voluntary right issues were offered to CFD holders or where CFDs were created as a result of a corporate action such as a stock split, some firms have incorrectly reported the notional amount of the transaction. In certain instances, entities reported a notional amount of ‘0’, implying a purchase price of zero, which does not accurately reflect the true value of the transaction.

How can TRAction assist?

If you need assistance in understanding whether a corporate event that has occurred or is due to occur within your organisation is reportable, or need specific regulatory assistance on how to report stock splits or other corporate events, please get in touch with us.