Since the updates to the EU & UK EMIR trade reporting regimes in April and September 2024, many reporting firms have been reviewing how to deal with the backloading of collateral and valuation information starting at the commencement dates of the updates to EMIR.

When entities undertake backloading for collateral and valuation data as necessary for EMIR, do you need to report the data for each day or only on the latest day? The short answer is that for incorrect historic data relating to margin, corrections are required for all days where data was incorrect or missing.

Requirement to report changes

Under the EMIR Rules (both EU & UK), entities are to ensure that the reports of their derivative trades contain details which are complete, accurate and reported on time (Article 9). The timeline for reporting a modification is the same as for the conclusion of a derivative, meaning when the modification is effective, it becomes reportable – “no later than the working day following the conclusion, modification or termination of the contract”. However, correction of data should be reported as soon as it was identified as being incorrect.

Approach to Backloading

The EMIR Guidelines provide that:

‘117. If there is an error in a historic valuation submission, only the valuation for that past date needs to be corrected and there is no need to rereport the correct valuations submitted after the incorrect valuation message. However, in the case where multiple ’Valuation’ messages had been incorrectly reported and corrections were required – the counterparty should submit a correction report for each day when incorrect valuation was submitted.

Counterparties should use the action type ‘Margin update’ when reporting collateral for the first time and also when reporting changes to the collateral information. However, this is not to be used for corrections being made to collateral information that was previously reported, for which the action type ‘Correct’ should be used.

ESMA further provides that in principle, they only expect one report per day with the action type ‘Margin update’. However, if incorrect collateral information has been submitted for a given day and then identified as being incorrect, a collateral report with action type ‘Correct’ for that day should be submitted. In the field ‘Event date’ and in the ‘Collateral timestamp’, it should be clear as to the day for which such correction is being made.

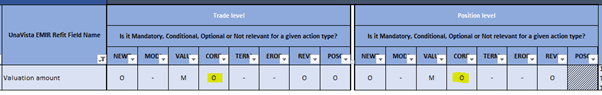

Also, as you can see from the Validation Rules (see table below) for ‘Valuation amount’, the reporting of corrections is optional both at a trade level and position level. This is also the same for UK EMIR.

The action type: ‘Correct’ is to be used for the correction of trade, valuation or margin data. Only reports with an action type relating to trade and/or valuation data will ensure that the derivative report is updated in respect of all the relevant fields. Sending the daily valuation and margin reports (through action types: ‘Valuation’ and ‘Margin update’ respectively) will automatically result in the relevant valuation and margin data being updated.

The FCA has clarified that collateral updates can be submitted for closed trades that were outstanding on the relevant event date. Reports of collateral updates may also be submitted for non-outstanding portfolios but which were open on the relevant event date. Such updates should not be submitted for transactions and portfolios that were closed / matured on the event date. This also applies for EU EMIR – as stated by ESMA in the EMIR Guidelines.

If you are also interested in the approach to backloading of collateral and valuation information under the ASIC & MAS trade reporting regimes, please see our article here.

How can TRAction assist with your trade reporting?

TRAction closely monitors trade reporting regulations and we ensure our clients are up to date and compliant with new global regulations as they continue to come about. We also help and guide our clients in understanding their trade reporting requirements for example, with nuanced matters in their trade reporting such as how to deal with backloading or corrections of incorrect reports.

If you have any questions in relation to your relevant trade reporting regime, please contact us.