Differences Between Trade Publication and Transaction Reporting in the UK and Europe

Data Enrichment

Compliance Support

Reduce Costs

Trade publication and transaction reporting are terms that are often a source of confusion for many firms trying to determine their regulatory obligations under MiFID II. The main difference relates to the respective audience and purpose: trade publication (TP) (also often called “trade reporting”) is directed to the public and made for disclosure purposes, whereas transaction reporting (TR) is made to regulators for oversight of transactions.

1. What’s the difference?

The differences between some of the main characteristics of TP and TR are summarised in the table below.

| Items | Trade Publication | Transaction Reporting |

|---|---|---|

| Audience | Public | Regulators |

| Purpose | Disclosure | Market oversight |

| Reported to | Authorised Publication Arrangement (APA) | Approved Reporting Mechanism (ARM) |

| Content | Instrument identifier, price, volume, timing, venue | More elaborate – information relating to execution algorithmic trades and decision-making, spanning 60 fields |

| Frequency | Near real-time | T+1 |

| Who has the obligation? | Seller, unless the buyer is a systematic internaliser | MiFID II investment firms |

2. Which do I need to prepare?

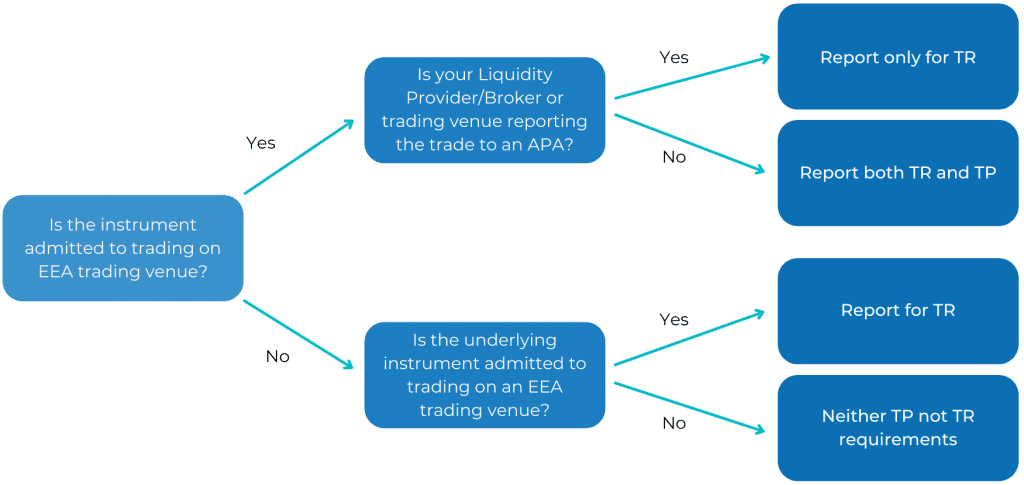

Your TP and/or TR obligations under MiFID II will depend on whether the instrument is traded on a European Economic Area (EEA) trading venue and if it isn’t, whether it has an underlying instrument traded on an EEA trading venue. The Financial Instruments Reference Data System (FIRDS), published by ESMA daily, will contain all the details of traded on venue. The decision tree below summarises these requirements.

It is important to note that although the terms ‘trade’ and ‘transaction’ refer to different reporting obligations under MiFIR, these terms are essentially interchangeable under EMIR. For more information on TP and TR and their distinctions or for help with determining your publication and reporting requirements, get in touch with TRAction.

Can't find the answers

you're looking for?

Get in touch with us for assistance.