Who Has Obligations to Meet MiFIR Trade Publication Requirements?

Data Enrichment

Compliance Support

Reduce Costs

Articles 6, 10, 20 and 21 of MiFIR require European Investment Firms (IFs) to make public, through an Approved Publication Arrangement (APA), post-trade transparency information in relation to financial instruments which are traded on a Trading Venue or traded over-the-counter (OTC)/off exchange.

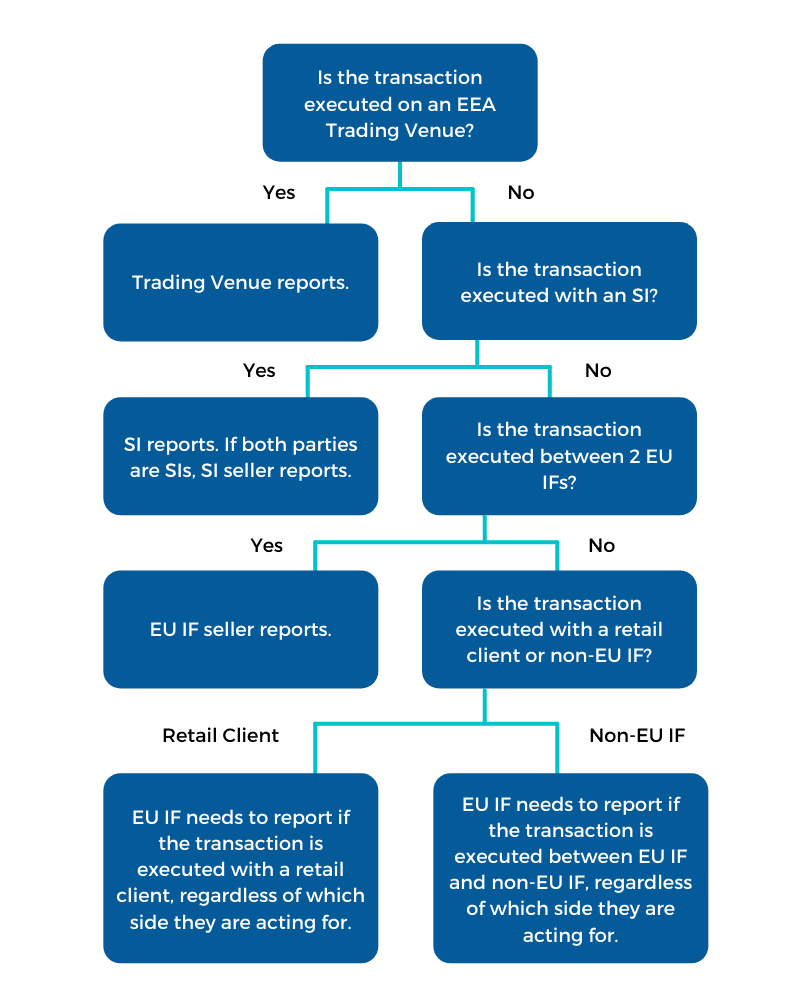

The obligation only requires one counterparty to report the trade data.

For transactions executed outside of an EEA trading venue, here’s some tips:

- Determine if you are a Systematic Internaliser (SI).

- Follow the hierarchy chart below.

We review some common scenarios and identify which party has the obligation to report post-trade transparency data.

1. Systematic Internalisers (SIs)

| Scenario | Buyer | Seller | Who has the obligation to report? |

|---|---|---|---|

| (a) | SI | SI | SI Seller |

| (b) | SI | IF | SI |

| (c) | IF | IF | SI |

As shown in scenario (a), if both IFs are also SIs, the seller has an obligation to report the post-trade transparency data (section 15 of RTS 1).

However, where the Investment Firm is a SI and it entered into a transaction with another non-SI Investment Firm (as in scenario (b) or (c) above), the SI will make the transaction public through an APA regardless of which side it is acting for (Article 12(5) of RTS 1 & Article 7(6) of RTS 2).

2. Investment Firms (IFs)

| Scenario | Buyer | Seller | Who has the obligation to report? |

|---|---|---|---|

| (a) | EU IF | EU IF | EU IF Seller |

| (b) | EU IF | Non-EU IF | EU IF |

| (c) | Non-EU IF | EU IF | EU IF |

As illustrated in scenario (a), if a transaction is executed between two EU IFs, the seller is required to make the transaction public through an APA (Article 12(4) of RTS 1 & Article 7(5) of RTS 2). If the financial instrument is entered between an EU IF and non-EU IF, the reporting obligation will rest on the EU IF regardless of which side they are acting for.

If both sides are non-EU IFs, they would be out of the scope of the obligations under MiFIR.

3. Retail Clients

| Scenario | Buyer | Seller | Who has the obligation to report? |

|---|---|---|---|

| (a) | EU IF | Retail Client | EU IF |

| (b) | Retail Client | EU IF | EU IF |

When a transaction is executed between an EU IF and a retail client, the obligation always rests on the EU IF, as a Retail Client is out of the scope of reporting obligations under MiFIR.

When does the post-trade information need to be published by?

Post-trade information shall be made available to the public as close to real time as is technically possible (Article 7 (4) of RTS 2) with the following parameters:

- on or before 3 January 2021, within 15 minutes after the execution of the relevant transaction;

- after 3 January 2021, within 5 minutes after the execution of the relevant transaction.

What needs to be published?

The following needs to be published in a post-trade report:

- Trading date and time;

- Instrument identification code;

- Unit price;

- Price currency;

- Quantity;

- Venue of execution;

- Publication date and time;

- Venue of Publication;

- Transaction identification code.

For more details see Table 3 of Annex I of the RTS 1.

For more information, review the Questions and Answers on MiFID II and MiFIR transparency topics published by ESMA.

If you are unsure whether you need to report post-trade transparency data, please don’t hesitate to contact us.

Can't find the answers

you're looking for?

Get in touch with us for assistance.