TRAction’s reporting services include data validation and data enrichment to identify and resolve errors as well as ensure the format meets requirements prior to Trade Repository (TR) submission.

We’ve identified the most common errors made in MAS OTC derivative trade reporting and provide steps on how to rectify each one. We also encourage MAS firms to review errors many ASIC regulated clients face as these are also applicable – see our article here.

1. The Valuation message cannot be linked with different Counterparty 2 (previously these fields were known as ‘Party2’ values) on the Existing Trades

This error message indicates that the valuation message submitted does not match the Counterparty 2 information already associated with the existing trade in the TR.

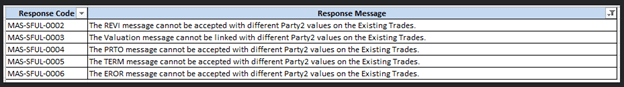

The TR expects the same Counterparty 2 identifier across the trade lifecycle. The error message appears as follows:

Why This Error Occurs:

The Counterparty 2 identifier in the valuation message does not match the identifier on the originally submitted trade.

This could occur due to errors in data entry in the client file, updates to the counterparty’s details or incorrect mappings in the system.

How is this fixed?

TRAction will conduct preliminary checks by cross-verifying the Counterparty 2 identifier (e.g. LEI or other identifiers – SWIFT BIC code, AVOX ID (or client code for individuals)) in the valuation message against the original trade submission to the TR.

TRAction will ensure that the Counterparty 2 identifier in the valuation message aligns with the identifier submitted with the trade.

If discrepancies are identified, TRAction will confirm the correct Counterparty 2 details with the client and ensure the accurate counterparty identifier is resubmitted to the TR.

2. Incorrect – Call or put amount for Foreign Exchange (FX) Derivatives with contract type OPTION

The exact error message for this would appear as follows:

- The CDE-Call amount must be greater than 0

- The CDE-Put amount must be greater than 0

What’s wrong?

This field is conditional for currency options where the asset type is CURR and the contract type is OPTN and the put/call is outlined in the product type UPI.

Key Requirements

Call/Put Amount Requirement: This field is required if:

- UPI.[Instrument type] = ‘Option’,

- UPI.[Asset class] = ‘Foreign Exchange’,

- UPI.[Product] does not equal Digital Option; and

- the Call/Put Amount must equal either the Notional Amount of the contract or Leg 1 or the Notional Amount of Leg 2.

Rejection Criteria: The field will be rejected if the value is negative or zero.

Additional Details

The field format is numeric and the value must be greater than zero.

The Call/Put Amount represents the monetary amount that gives “Counterparty 1” the right to buy/sell, where applicable.

Derivative contracts, including options, are legal agreements where a counterparty has an obligation to deliver to its counterparty, the currency, if the option is exercised. Without a positive value, the contract lacks enforceability and a zero call/put amount would render the derivative untradeable, as it does not have a notional value.

As the error message states, TRAction cannot report this transaction with call/put amount less than zero.

How is this fixed?

When this issue arises, TRAction reach out to the client and request that they update the relevant field in the file they provided. Once the client submits the corrected call amount, TRAction address the exceptions, make the necessary amendments and resubmit the updated data to the TR.

3. Action Type cannot be submitted when underlying trade is not existing

The error “Action Type cannot be submitted when underlying trade is not existing” indicates that an action type message (e.g. amendment, valuation or termination) has been submitted to the TR without a corresponding underlying trade being present or recognised in the repository with an action type “NEWT”.

When initially reporting a new derivative to MAS, the action type is submitted as either “NEWT” or “POSC” to indicate a new transaction. If the transaction remains open, any subsequent updates such as valuation, modification, or termination are reported using the appropriate action types: “VALU” for valuation updates, “MODI” for modifications, and “TERM” for terminations.

According to the lifecycle rules under the MAS Trade Reporting Regulation, a derivative can only be submitted with the action type “NEWT” as the initial trade status, signifying the creation of the original trade.

How is this fixed?

The TRAction team will ensure the trade’s status is active in the TR before submitting the relevant action type. If any data is unclear or missing, the team will contact the client for corrections, reprocess the data and submit the fix to the TR.

If you have any questions, please feel free to contact us.