iFX EXPO Asia – The Open Banking Momentum APAC is Bridging Gaps

The Open Banking Momentum APAC is Bridging Gaps TRAction’s co-CEO Sophie Gerber was recently featured on ‘The Open Banking Momentum: APAC is Bridging Gaps’ panel at iFX EXPO Asia 2024 in Bangkok! Learn how enhanced financial access can stimulate economic growth and promote social inclusion, by improving pricing and reducing financial crime risks, and hear […]

Payment frequency period – Leg 1 & 2 – ASIC Rewrite

Payment frequency period multiplier – Leg 1 & 2 – ASIC Rewrite

Interbranch and Intragroup Trading – Reporting Requirements

Is reporting of interbranch or intragroup transactions required? Are there any exemptions that apply to such trading activity? An ‘interbranch transaction’ is a transaction that occurs between branches of the same legal entity e.g. a Sydney branch enters into a trade with a Singapore branch of the same firm. An ‘intragroup transaction’ is a transaction […]

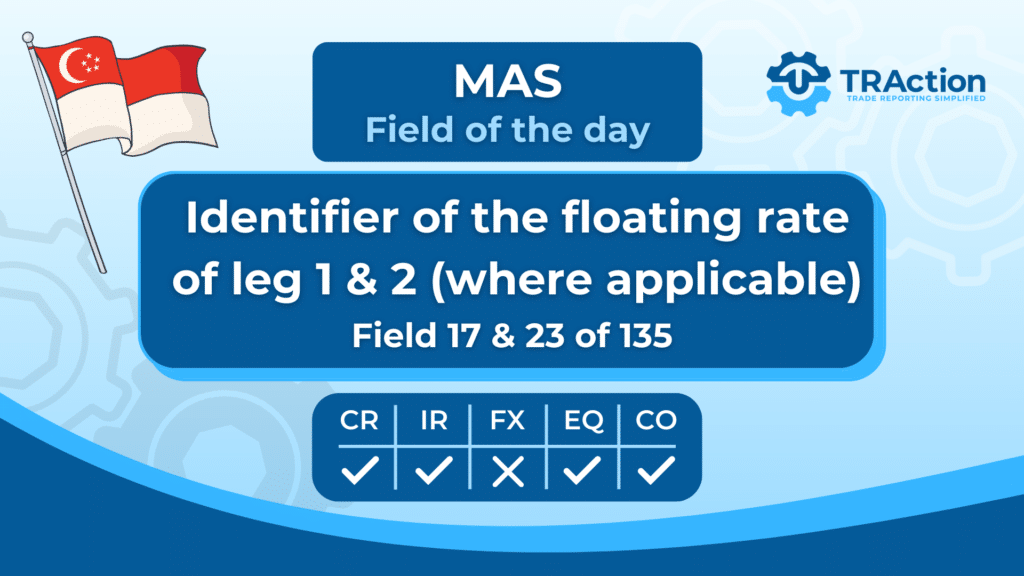

Identifier of the floating rate of leg 1 and 2 – MAS Rewrite

Latest Go-Live: Blueberry x TRAction

Blueberry has officially launched its advanced transaction reporting in Australia using TRAction’s trade reporting solution, seamlessly integrated with MetaTrader 4 (MT4). TRAction’s integration with MT4 has been harnessed to facilitate ASIC transaction reporting for Blueberry. TRAction’s, a leading provider of trade reporting solutions, and MT4, a recognised electronic trading platform, place great importance on the […]

Day count convention Leg 1 & 2 – ASIC Rewrite

ASIC Rewrite – are there any pairing and matching requirements?

Historical background To date, the ASIC trade reporting rules have not required counterparties to have exactly matching data in the relevant fields of a trade report. Even though that counterparties to a trade should have the same core information about that trade, reporting requirements and the need for data enrichment has meant data elements could […]

Underlying (where applicable) – MAS Rewrite

MAS Rewrite – FAQs published

MAS recently updated its FAQs to address common themes from the MAS Rewrite changes. MAS Rewrite issues discussed in this article will be effective from 21 October 2024 (the Implementation Date). The updated FAQs focus on: reporting on Contracts For Difference (CFDs), Collateral reporting, ‘re-reporting, and UTI and UTI generation. CFDs – Position reporting on […]