In the first half of 2025, ASIC engaged with several Australian CFD providers after evidently having done a large-scale analysis of their reported data. One of the main issues raised by ASIC related to ‘Unique IDs’. There still appears to be some confusion in the CFD market around its root cause and resolution. Part of the misunderstanding may stem from the use of the term “unique”.

Why does ASIC request a ‘Unique’ Client Code or ID?

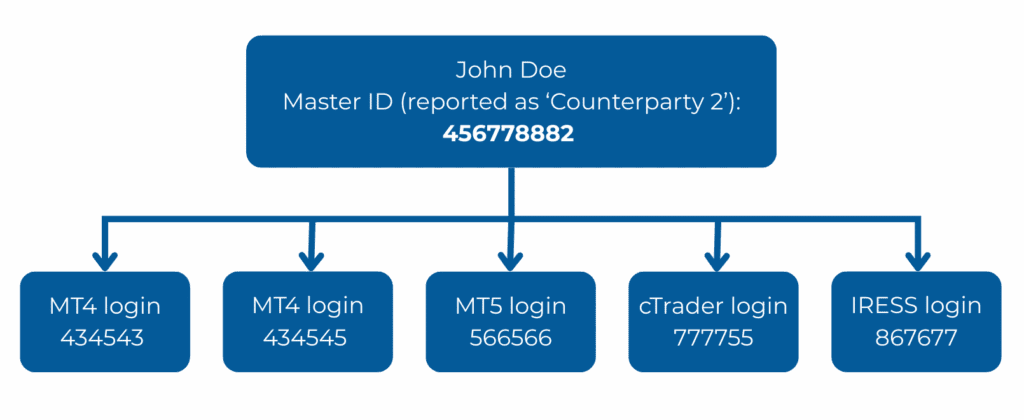

A Unique Client ID is more commonly known in industry parlance as a ‘global ID’ or ‘master ID’. ASIC requires firms to use a single central identifier that consistently represents the Counterparty 2 to a transaction, regardless of the specific platform or login used. ASIC wants to have visibility of profit and loss, as well as exposure, at a client level across all of a client’s trading platforms.

How does this issue arise?

Recently, there have been instances of Australian CFD providers reporting multiple Counterparty 2 identifiers for the same person/ legal entity. This arises when CFD providers’ clients trade with multiple accounts or logins, leading to duplicate identifiers of their counterparties.

See below example of how a client (who is Counterparty 2), may have various platform IDs and logins under their relevant Unique Client ID and legal name, as they are using multiple platforms for their trading:

| Unique ID (master) | Legal name | Platform | Login / Platform ID |

|---|---|---|---|

| 456778882 | John Doe | MT4 Standard | 434543 |

| MT4 Pro | 434545 | ||

| MT5 | 566566 | ||

| cTrader | 777755 | ||

| IRESS | 867677 |

Ideally, the Unique Client ID would be created at the time the client first opens an account and completes their KYC. It would typically be stored in a back-office system or customer relationship management (CRM) system.

Note that TRAction is not able to generate the MasterID from the platform-specific IDs previously received, as there is no way to link multiple logins to a single individual. It is for this reason the unique ID must come from the CFD provider.

TRAction’s approach to rectifying this issue

For ASIC reporting, TRAction provides its clients with a template which links the back-office account (at the individual/entity level) with all of the individual/entity’s trading accounts. This template should be populated by firms exporting from their back-office system. This should also correct the issue where there are non-named data being reported in the name field like ‘ACC#2(USD)’ as such information would not be present in the back-office account level record for the relevant person.

How can TRAction assist?

If you require assistance in understanding the technical detail required for any of the trade reporting regimes or anything else on how to comply with your trade reporting obligations, please contact us.