Understanding National IDs in MiFIR Transaction Reporting

Data Enrichment

Compliance Support

Reduce Costs

Natural Person Identifiers in MiFIR Transaction Reporting

Natural person identifiers are an important part of transaction reporting and contain some complexity in their application due to the variety of identifiers available.

It’s widely-known that corporate counterparties need to be identified by their Legal Entity Identifier (LEI) in MiFIR transaction reports. This is simple and straight-forward.

Where the counterparties are natural persons, the reporting of natural person information including identifiers, names and dates of birth will be required.

Which natural person identifiers should you use?

Annex II of RTS 22 applies to all EU and UK investment firms as to the type of identifier to use according to the nationality of a natural person counterparty. The type of identifier to be used will depend on the priority given.

Basic rule

| Basic rule | Two-digit “alpha-2” code plus Annex II identifier | |

|---|---|---|

| Priority of identifiers | The highest priority identifier that a person has as provided in Annex II should be used. It is not relevant that an investment firm may not know the highest priority identifier. |

|

| EU Investment Firm |

||

| Nationality(ies) of the natural person |

||

| EEA | The two-letter “alpha-2” code and the identifier provided in Annex II (i.e. same as EEA only nationality) |

|

| Non-EEA (including UK) | “All other countries” field in Annex II to be used – this is the National Passport Number and CONCAT (see column to the right) |

|

| More than one European Economic Area (“EEA”) country | Use two-letter “alpha-2” code which is first when arranged alphabetically and use corresponding identifier from Annex II. |

|

| UK Investment Firm |

||

| Nationality(ies) of the natural person |

||

| UK | The two-letter “alpha-2” code and the identifier provided in Annex II (i.e. UK National Insurance number as first priority) |

|

| UK and EEA | The two-letter “alpha-2” code and the identifier provided in Annex II (i.e. UK National Insurance number as first priority) |

|

| EEA | The two-letter “alpha-2” code and the identifier provided in Annex II (i.e. same as EEA only nationality) |

|

| Non-UK and non-EEA | “All other countries” field in Annex II to be used – this is the National Passport Number and CONCAT |

|

What is CONCAT?

‘CONCAT’ is the concatenation or combination of the following four elements:

- Two-letter “alpha-2” code

- Date of birth (YYYYMMDD)

- First five characters of first name

- First five characters of surname

Additional rules:

- For first names and surnames, prefixes and punctuation are excluded.

- If the name is less than five characters then use # to fill remaining spaces

Example:

For an EU investment firm with a counterparty from Belgium, the 1st priority would be the Belgian National Number. If this identifier is not available, then CONCAT would be used as a 2nd priority. The 3rd priority is not available for Belgium nationals but is available for some others.

| ISO 3166-1 alpha 2 | Country | 1st priority identifier | 2nd priority identifier | 3rd priority identifier |

|---|---|---|---|---|

| AT | Austria | CONCAT | ||

| BE | Belgium | Belgian National Number (Numero de registre national – Rijksregisternummer) | CONCAT |

What about UK nationals?

Before Brexit, the national ID requirement under MiFIR for a UK national was UK national Insurance Number as priority 1 identifier and CONCAT as priority 2.

After Brexit (1 January 2021), the UK is no longer part of the and is treated as a third country under EU MiFIR reporting.

As a UK investment firm, the requirements for reporting a UK national remain the same as pre-Brexit, where the first priority identifier is the UK National Insurance Number and if this identifier is not available, then CONCAT will be the second priority.

However as an EU investment firm reporting a UK national, the UK is classified as a third country. Therefore you will need to use the requirements under the category of ‘all other countries’, being National Passport Number as 1st priority identifier, CONCAT as 2nd priority.

| All other countries | National Passport Number | CONCAT |

What do you need to do?

Recommendation 1 – All Clients

We suggest you take the opportunity to review your client onboarding process against Annex II of RTS 22 to ensure that you are requesting the appropriate national identifier information for each client based on their nationalities. It may be worthwhile reviewing national identifiers held across your entire client base to ensure they are current and have provided you with the highest priority identifier they have available.

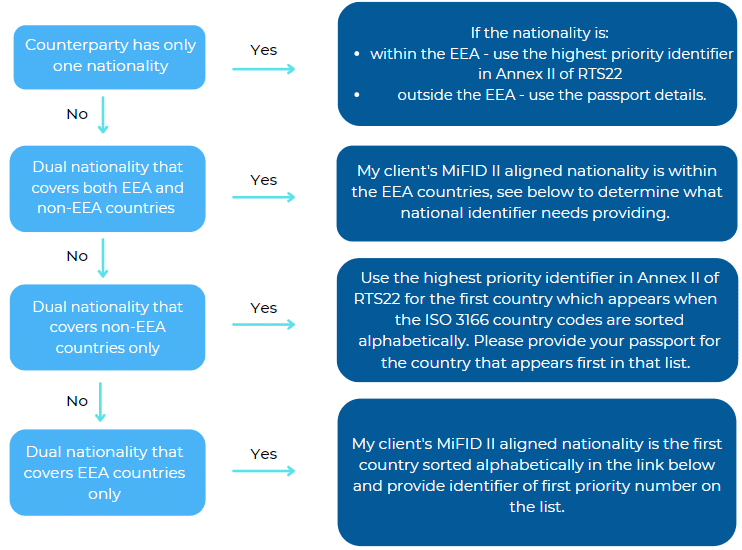

TRAction suggest you follow up your clients to ensure you have made best endeavours, as required under MiFIR regulation. Use the flow chart above to determine your client’s natural person identifier requirements.

Recommendation 2 – UK Nationals

Whether your clients that are UK nationals were onboarded before or after Brexit, you are now required to report their passport numbers. Therefore you should:

- UK nationals onboarded before Brexit – update their details in your system with their passport numbers.

- UK nationals onboarded after Brexit – always collect their national passport details.

Will the transactions/identifiers get rejected based on validation?

You should ensure that you have appropriate validation processes in place when collecting the natural person identifiers across the various nationalities so that where there are any queries by a regulator you have appropriate records to provide.

It is not possible for an Approved Reporting Mechanism (ARM) to validate if the correct priority identifier is used in your reporting, or whether the right nationality is reported. This means a report may be accepted by the ARM without necessarily being technically correct according to RTS 22. However, this does not mean that a future and more in-depth review of your reporting by a regulator will not highlight the importance of following these national client identifier requirements.

Fields requiring population of a natural person or corporate identifier

| Field number | Field name | Input (if subject is natural person) |

|---|---|---|

| Buyer Fields |

||

| 7. | Buyer identification code | Corporate identifier/Natural person identifier |

| 8. | Country of the branch for the buyer | Country code |

| If buyer is a client and a natural person: |

||

| 9. | Buyer – First Name(s) | First name(s) |

| 10. | Buyer – Surname(s) | Surname(s) |

| 11. | Buyer – Date of Birth | Date of birth |

| If buyer is a client and acting under a power of representation: |

||

| 12. | Buyer decision-maker code | Natural person identifier |

| If buyer is a client, acting under a power of representation and natural person |

||

| 13. | Buyer decision maker – First Name(s) | First name |

| 14. | Buyer decision maker – Surname(s) | Surname |

| 15. | Buyer decision maker – Date of Birth | Date of birth |

| Seller fields |

||

| 16. | Seller identification code | Corporate identifier/Natural person identifier |

| 17. – 24. | [Mirror buyer fields 8. – 15.] | [Mirror buyer fields 8. – 15.] |

| Investment decision and execution |

||

| 57. | Investment decision within firm* | Corporate identifier/Natural person identifier |

| 59. | Execution within firm* | Corporate identifier/Natural person identifier |

*To learn how to populate these fields and the “trading capacity” field, please visit our page – MiFIR Reporting for STP Brokers.

If you still have any questions, please contact us.

Can't find the answers

you're looking for?

Get in touch with us for assistance.