Single-Sided Reporting

Data Enrichment

Compliance Support

Reduce Costs

What is single-sided reporting?

Australia’s current OTC derivatives reporting regime requires both parties to a derivative transaction to report to an Australian Derivative Trade Repository (ADTR). However, there is relief under the current reporting regime to allow for single-sided reporting, i.e. where only one party is required to report under the Reporting Rules.

The relief changed slightly on 20 October 2025 and it is important firms check they still qualify for the relief after that date or otherwise make arrangements to start reporting (and potential complete a back-load of any missed transactions).

From 20 October 2025, ASIC removed the alternative reporting arrangements which operated as a form of substituted compliance. This reduced the trade repositories (TRs) which qualify for the single-sided relief provisions – only ADTRs now qualify.

Given the changes that commenced on 20 October 2025, we encourage firms to:

- consider the changes to single-sided relief and determine whether their firm should start reporting relevant transactions where it involves the counterparty reporting to what was previously known ‘prescribed’ repository overseas – note, a crucial change which came in was the de-prescribing of the ‘prescribed’ repositories (discussed below in detail);

- discuss with counterparties who have provided single-sided relief in respect of their reporting to a ‘prescribed’ repository overseas whether they can offer reporting to an ADTR from (or before) 20 October 2025. Otherwise, arrangements to comply with the Reporting Rules will need to be implemented; and

- consider whether the firm has transactions subject to the Exemption described below.

Current Single-Sided Relief – commenced 20 October 2025

- Main changes

As of 20 October 2025, trades with foreign firms need to be reported by ASIC regulated firms irrespective of what the counterparty’s or liquidity provider’s reporting requirements are (i.e. assuming your counterparty / LP doesn’t report to ASIC).

That’s because under the new single-sided relief provisions in ASIC Rewrite, ‘prescribed’ repositories have been removed as an allowable reporting destination i.e. now you can only use ‘licensed ADTRs’ as listed on ASIC’s website. References to ‘prescribed’ repositories in relevant regulations have been removed. As new ADTR licences are granted, the names of such licensed ADTRs have been added to ASIC’s website.

- Single-sided reporting exemption (Exemption)

There is an exemption for reportable transactions that are classified as ‘a modification, termination or assignment, or a change to the way a Reporting Entity records an OTC Derivative in its books and records, . . . that was reported to a Prescribed Repository before the removal of the alternative reporting provision.’

The overarching requirement under the Reporting Rules is that a reporting entity must report any changes in information relevant to an OTC transaction that has been previously reported. However with the exemption, there is not a requirement to report changes in information relevant to the OTC transaction where the reporting was to a ‘prescribed’ repository before 20 October 2025. This reflects ASIC’s changes to only using ASIC’s licensed ADTRs.

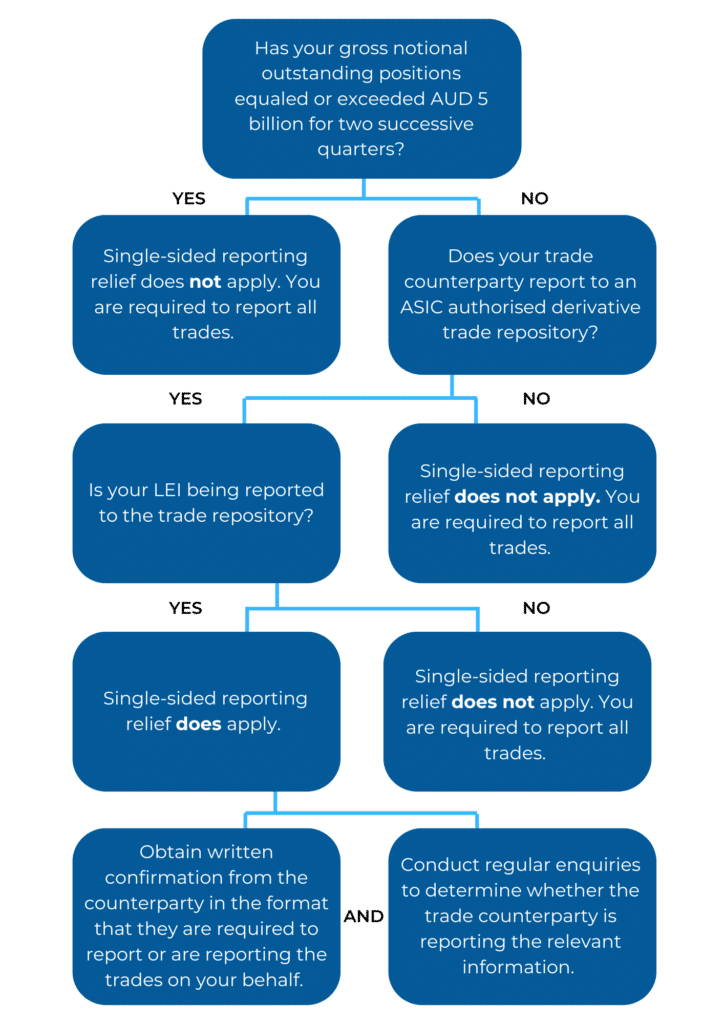

Decision-making on single-sided relief from 20 October 2025

Use the diagram below to help determine whether the single-sided reporting exemption will be applicable to you after 20 October 2025:

Previous Single-Sided Relief regime

To qualify for the single-sided reporting relief under the previous framework (i.e. prior to 20 October 2025), there were two requirements that must be satisfied:

1) Gross notional outstanding position must be less than A$5 billion for two consecutive quarters

The single-sided reporting relief applied to:

- Authorised Deposit-taking Institutions (ADIs);

- Australian Financial Services Licensees (AFSLs);

- clearing and settlement facility licensees; and

- exempt foreign licensees,

with total gross notional outstanding position across all OTC derivatives of less than A$5 billion at the end of two consecutive calendar quarters.

If a reporting entity reached the A$5 billion threshold for two consecutive quarters, the single-sided relief ceased to apply and full reporting obligations (i.e. dual sided reporting) applied instead. This meant that a reporting entity could move in and out of the relief depending on the changes in the size of their derivatives portfolio at the end of a calendar quarter.

2) The other counterparty is already required or has agreed to report

The reporting entity also needed to ensure the other party to the OTC derivative is a reporting entity:

- required to report information about the trade under the Reporting Rules and not relieved from that requirement under the single-sided relief; or

- who otherwise reports information about the trade under the Reporting Rules

If the other party did not satisfy any of the above (e.g. end customer is not a reporting entity), the relief will not be applicable even if the reporting entity can satisfy the first requirement.

What do I need to do if I want to apply single-sided relief?

If you wish to rely on the single-sided relief, you will need to communicate with your counterparty (reporting counterparty) and obtain a representation from them pursuant to Reg 7.5A.73 of Corporations Regulations 2001 (Cth) (note this is reg 7.5A.72 in the current single-sided relief provisions but is updated from 20 October 2025). Although the legislation does not provide what representation is required, we have prepared a template letter which can be used – please contact us to obtain a copy.

How can TRAction help?

TRAction assists our clients to understand whether they are eligible to apply for the single-sided relief. Please contact us if you would like to know more about how TRAction can assist you.

References

ASIC Derivative Transaction Rules (Reporting) 2024 (Reporting Rules)